We’re building the 2026 agenda now! In the meantime, take a look at the 2025 program to see the caliber of content and speakers you can expect.

Join us at the conference’s Bank of the Future kick-off reception, where innovation and iteration come together.

Get ready to accelerate your journey into digital banking’s next big phase while forging meaningful connections with industry pioneers, trailblazers and disruptors.

Start your immersive experience at the Bank of the Future kick-off reception. Let’s toast to innovation, connection and the exciting road ahead!

Nathan McCauley leads the only federally chartered digital asset bank—Anchorage Digital—and partners with other banks looking to crack into crypto. With regulatory progress and market momentum driving more institutions into the digital-asset ecosystem, McCauley unpacks why banks of all sizes need to develop comprehensive crypto strategies today to remain competitive as the crypto industry swiftly evolves. Drawing on insights from the latest in blockchain innovation—including tokenization, stablecoins, and wealth management solutions—McCauley outlines how banks can dive into digital asset technology to create new revenue streams while meeting client demand.

American Banker surveyed banking leaders to understand the unfolding role that data and artificial intelligence (AI) is expected to have on the customer experience in banking. The research looks at the use cases banks are prioritizing and the impact on customer journeys. The session explores the research findings and the characteristics and best practices that define data-driven banks to better understand their overall readiness for AI adoption.

A candid conversation about the modern leadership opportunities and challenges of steering a high-profile neobank into its next chapter.

Introduction by Holly Sraeel, SVP, Strategy and Content, American Banker Live Media

Gain strategic insights and practical tactics for optimizing your banking environment to effectively combat the threats posed by cyber risks and losses resulting from increasingly sophisticated attacks and fraud.

Indulge in a taste of tomorrow at the Bank of the Future Lunch, exclusively hosted on the Experience Hall floor during the DIGITAL BANKING Conference.

Sustainable innovation in financial services isn’t about chasing the next big thing. It’s about building the kind of infrastructure and partnerships that consistently deliver leading next-generation consumer experiences. In this fireside chat, we explore how Fifth Third’s approach to digital transformation avoids fragmentation. Instead of launching standalone digital products, they’ve invested in a unified relationship banking model, one that seamlessly connects branch, digital, and contact center experiences. Their modernization efforts emphasize cloud-native, API-first architecture designed to boost agility, interoperability, and long-term flexibility. The conversation will also highlight how bank-fintech partnerships enhance their ability to meet evolving consumer expectations and engagement.

As consumer debt reaches unprecedented levels, financial institutions have a unique and crucial role in empowering their customers and driving positive change. This session will explore practical applications of leveraging technology and analytics to streamline the consolidation process and enhance decision-making. Join us as we explore the future of debt consolidation and how financial institutions, as key players, can take charge of empowering customers to achieve their financial goals.

The benefits of a bank partnering with a sports team include increased visibility, community and business engagement, and expanded market reach. But it takes more than just slapping a team logo on the bank’s marketing materials. In this session, learn what it takes to build a purposeful partnership that drives awareness and impact in a meaningful way. Panelists will discuss how to create unique experiences for clients and customers, how to create synergy between both brands, and how to drive value together.

As financial institutions navigate complex regulatory requirements and prioritize data security, the right foundation and architecture ensures they can fully exploit AI technologies while safeguarding sensitive information. What are the enabling architectural principles of supply chain data? Join us to learn strategies for building an adaptive, intelligent banking ecosystem with generative AI at its heart.

Synethic identity fraud, which is projected to cost banks $23 billion by 2030 (and more in operational and reputational costs), is on the rise, and it’s getting more complex with the use of general artificial intelligence and deepfakes by bad actors to carry out attacks. Fraudsters rely on automated tools to create and scale AI-generated fake identities and documents across multiple platforms, exploits gaps in identity verification systems, notably with digital accounts. To prevent the orchestration of ID fraud, banks must work to shore up points of vulnerability and secure digital platforms to guard against data breaches that expose sensitive data that makes it easier for ID theft to occur. Industry practitioners and experts detail why proactive usage of AI/machine learning, strong identity verification, Know-Your-Customer technology-enabled document verification, and tokenization of customer data are required to combat ID fraud.

In this panel, fintech and banking leaders discuss how they’re partnering to build new products that redefine traditional CFO responsibilities and unlock new opportunities for growth and innovation. Panelists will explore how embedded finance is reshaping how CFOs manage financial operations, enabling greater visibility into cash flow and improved decision-making.

In a fireside chat, discover the myriad ways that financial institutions are transforming the customer experiences across channels. Hear directly from bank executives as they share real-world success stories, highlighting the tangible benefits and measurable outcomes these digital tools deliver. The panel discussion provides valuable insights, key actionable takeaways and inspiration to meet diverse, ever-evolving needs of customers within your banking universe.

Introduction by Carter Pape, Technology Reporter, American Banker

Learn about this successful partnership offering that was critical to the success and development of Key Virtual Account Management (KeyVAM). Qolo’s next-generation infrastructure provides instant access to payments data, analytics, card and account generation, and money movement. What you’ll learn: The work that went into bringing it to life, the collaboration of the partners, the technology, and the measurable success based on impact and scalability.

Hear the latest trends in fraud and new novel ways victims are being targeted. Explore the growing threat landscape and how AI tools are both helping and hindering fraud prevention efforts. Learn the risks associated with third-party software and actionable recommendations for managing these relationships.

AI is transforming financial crime compliance, but where is it delivering real results today? While much of the industry’s focus has been on customer-facing AI, the biggest impact may be in streamlining compliance, reducing risk and improving decision-making behind the scenes. In this panel, industry participants share their insights into how AI is being used to enhance compliance workflows, improve risk assessment, reduce friction between clients and regulatory requirements, and increase collaboration between institutions and AI experts.

What’s Now, What’s Next – Insights into AI and the Future of Digital Banking A Conversation with Lino Catana, Head of Digital Product Management, TD Bank

Discover how to accelerate customer empowerment while “rightsizing” your bank’s omnichannel customer experience through retail, digital, and contact centers. Explore strategies for guiding customers to leverage all touchpoints effectively, empowering them to navigate their banking needs confidently. Gain insights into the behind-the-scenes data and tools that support this transformation—connecting the dots to empower customers at every touchpoint—and bridge the gap to ensure customers experience a truly integrated banking journey.

Introduction by Rahul Kumar, GM & VP, Financial Services and Insurance, Talkdesk

When the Consumer Financial Protection Bureau released its final rule under Dodd-Frank’s Section 1033, the world of open banking and finance was set to change in unprecedented ways, not least of which is banks’ ability to innovate faster and remain agile by “co-creating” value-added products and services developed by fintechs, while still remaining compliant with requirements to protect the consumer data that is accessed and shared. An expert panel discusses the monetization and innovation potentials of APIs-as-a-Service to fintechs and the emergence of open API marketplaces, advantages of proactive compliance, third-party risk management, the need for data architecture upgrades to handle real-time access and sharing, and monitoring systems to track data access and security.

In this detailed session, KeyBank and Personetics explore how “Cognitive Banking” is reshaping the industry, and how KeyBank is building trust through tailored guidance, turning mobile interactions into meaningful relationships that drive mutual value. Learn what KeyBank’s financial mobility survey revealed customers expect: They don’t just want transactions, they want trusted guidance that improves their financial well-being and daily decisions. For banks, gain insight from KeyBank into how robust data cleansing and enrichment can deliver value for both customers and the bank. By improving transaction descriptions and accuracy, banks can enjoy substantial benefits in call center inquiries, saving millions while automating customer service in a mobile-first world where 90% of traffic comes through digital channels. The benefit to shareholders? Measurable impact of targeted engagement on cross-selling, upselling, and customer retention, creating lasting value through deeper relationships rather than transactional interactions.

Why Dynamic AI Modeling Using Diverse Data Continues to be a Game Changer

Already an influential force in digital finance, the ever-expanding ability of artificial intelligence and big data models to analyze more diverse data sources—including social media, spending habits, transaction history, alternative data and more—in real time gives banks and fintech players the ability to assess risk through a more dynamic lens and optimize operational efficiency. Experts outline the expanding, powerful knock-on effects, including enhanced risk management through more accurate credit scoring and credit extension, better machine-learning-driven fraud detection and prevention, and the creation of richer customer profiles that enable “instant” insight-based decision making and customized product offerings based on individual behaviors.

Combating cyber risks and fraud in today’s digital banking environment, where threats are becoming increasingly sophisticated, and more vulnerabilities are being exploited, requires institutions to develop a multi-layered, iterative approach to cybersecurity that safeguards sensitive data, adheres to regulation, and proactively anticipates and mitigates risks. Learn from industry executives and cybersecurity experts on the evolving sophistication of cyber-attacks and what components of a comprehensive cybersecurity strategy are most critical, including a robust cyber infrastructure, artificial intelligence-driven fraud detection systems, advanced authentication and access controls, cyber resilience and risk testing, and cyber incident response guidelines for distributed denial-of-service attacks, ransomware, insider threats, phishing and social engineering, and more.

How Co-Locating Talent Across Tech, Operations, and Client-Facing Teams Accelerates Innovation and Responsiveness

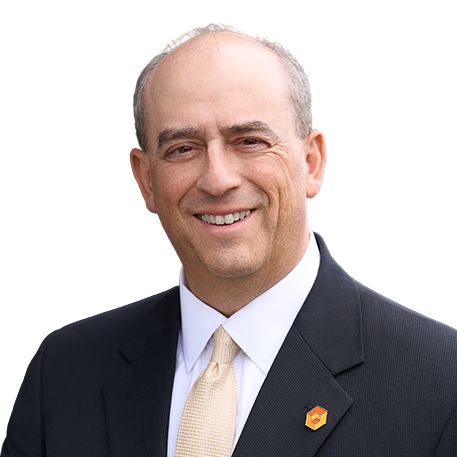

By bringing together diverse skill sets and perspectives, how can companies foster a culture of collaboration and creativity, driving solutions that meet client needs? In this fireside chat, BNY’s Chief Administrative Officer Alejandro Perez will discuss the global bank’s strategy in co-locating talent in order to break down silos, increase knowledge sharing, reduce time-to-market for new products and services and deliver a world-class client experience.

With digitization being a necessity to meet customer expectations, the financial industry needs to embrace their local and relationship building “roots.” Credit unions need to identify relevant strategies to bring the best of the in-person experience to digital channels. Credit union leaders discuss which aspects of physical banking interactions should be translated into digital experiences; how to prioritize and test UX for ease of use and accessibility; how to use data and transaction history to offer customers the right product at the right time; and when to implement self-service options versus those that require more in-depth discussion and support.

Wind down and network in style as the day’s excitement culminates in our exclusive Experience Hall cocktail reception. Join fellow attendees, speakers, and innovators for an evening of mingling and celebration. Savor delectable hors d’oeuvres and signature cocktails as you reflect on the day’s insights, discoveries and key action items.

American Banker‘s annual Innovation of the Year list pays tribute to the brightest minds in finance and technology. Honorees are recognized at a prestigious awards dinner. To request an invitation to attend, please email Maria Lopez at maria.lopez@arizent.com.

Marketing deposits through digital marketplaces and comparison tables was once a strategy reserved for the biggest brands. No more. Banks and credit unions of all sizes and digital savvy are now achieving strong results advertising their rates online, particularly for Certificates of Deposit (CDs). Whether your institution has location or membership restrictions or is seeking nationwide reach, digital marketplaces are a highly cost-effective strategy to efficiently reach high-intent prospects inside or outside of your traditional footprint. The session will include an overview of the dynamics of digital deposit marketplaces and online deposit advertising; an up close look at a community bank’s CD campaign on a digital marketplace and its impact; and analysis of the role of digital account opening and customer service in participating in a digital marketplace.

NewtekOne, established in 1998, recently acquired a manual, single branch New York City-based bank, and by utilizing technology, people, and process, has transformed what is now known as Newtek Bank, N.A. into what it believes is the first true technology-oriented bank with no branches, traditional bankers, brokers, or BDOs. Newtek Bank has opened 15,000 depository accounts remotely and is the largest SBA government guaranteed lender in the United States in the most recent full fiscal year. Come hear how they did it, and how you can do it, too.

Artificial intelligence is enhancing the customer experience across bank channels, creating personalized experiences, streamlining processes, improving security and increasing self-service capabilities. As banks’ mobile-first strategies evolve, customers are being empowered to make better informed financial decisions and engage with their institutions in more proactive, meaningful ways. From AI chatbots that provide instant customer support and basic financial guidance, to online portals and mobile apps that allow clients to access their accounts and execute transactions whenever they want, wherever they want, mobile-first banking is at the center of the customer experience. Learn how enhanced digital experiences, AI integration and increasingly personalized products and services are creating a seamless experience that meets customers’ radically changing expectations.

Explore how AI is redefining the digital banking landscape, from strategic planning to scalable execution. This session highlights how CDW, in collaboration with industry-leading partners, is helping financial institutions build intelligent, secure and agile infrastructures. Learn how AI agents are enabling real-time fraud detection, personalized customer engagement and efficient transaction management, all supported by responsible governance and seamless IT orchestration. Discover how your organization can harness this innovation to deliver next-generation banking experiences.

Introduction by Melinda Huspen, Technology Reporter, American Banker

The tidal wave of fintech innovation that is transforming financial services shows no signs of retreating, as open banking, emerging technologies and customer expectations continue to evolve the industry at an accelerated pace. Bank-fintech partnerships have been instrumental in shaping the future of global digital finance, delivering seamless, mobile-first solutions, but operational risks and regulatory compliance must be managed and met by models that foster collaboration and ensure safety and soundness. Industry participants and experts weigh in on how these innovation-based partnerships are expanding access to banking services, optimizing the customer experience, speeding product development, and increasing operational efficiency—all with an eye on establishing a framework for bank-fintech partnership that manages risks and compliance without compromising innovation.

As banks adopt use cases for generative AI, the benefits are clear in pockets. However, optimization of Bank operations remains elusive despite billions spent on copilots to improve functions like legal, product design, software engineering, security testing, and portfolio management. Managing the portfolio of AI initiatives and redesigning organizations has lagged. Learn how banks are managing and modeling GenAI initiatives across the enterprise to drastically improve time to market for digital initiatives.

Introduction by Bailey Reutzel, Senior Director, Strategy and Content, American Banker Live Media

Perhaps nowhere is artificial intelligence more vital to digital banking than in identifying risks and ensuring compliance with regulations, while also increasing operational efficiency and futureproofing against known and unknown risks. If financial institutions want to develop a modern-day playbook for AI-driven compliance and risk management, then learn from these experts and practitioners on how to develop an integrated approach that will ensure a compliance framework that meets banks’ needs in a complex regulatory environment with greater efficiency.

In an increasingly digital world, trust is built not just through products, but through seamless, secure, and thoughtful experiences. In this fireside chat, leaders from Citizens and Plaid will explore how financial institutions can leverage technology to meet evolving customer expectations while deepening relationships. Hear how Citizens approaches innovation with a customer-first mindset, and how collaboration can offer more intuitive, impactful digital experiences. This conversation will offer practical insights on using innovation as a tool for long-term retention and engagement.

With BaaS under regulatory scrutiny, what’s next for bank–fintech partnerships? Ingo Payments CEO Drew Edwards moderates a candid conversation with leaders from KeyBank and Pathward to explore why banks still need fintechs, how to manage risk, and what successful collaboration looks like in today’s evolving service economy.

Cyber risk-related fraud in financial services is increasing in frequency, sophistication and type of attack at an alarming rate, in part due to the increasing usage of artificial intelligence by bad actors.. By 2025, some experts predict that the costs from global cybercrime could reach $10.5 trillion annually.The good news: AI is being used by banks and financial institutions to fight fraud. The panel outlines a modern-day playbook for using AI to reduce fraud across channels.

Introduction by: Carter Pape, Technology Reporter, American Banker

Delve into the strategies and tools that can help you leverage digital solutions to drive business banking growth and enhance customer experience. Discover how digital transformation can streamline operations, improve customer engagement, and support your business objectives.

Introduction by Carter Pape, Technology Reporter, American Banker

Why Digital-First Wealth Platforms and Banks See a Hybrid Model as a Wealth Generator for All

Banks’ customer relationships are becoming increasingly transactional, putting trust and loyalty in play. As a result, three-quarters of customers have a relationship with at least one other bank. With digital challengers and fintechs gaining ground, traditional banks need to strengthen their positions—fast. Learn what steps to take to engage customers through data-driven personalization that puts tailored experiences, advice, and new products into their hands.

Generative artificial intelligence is driving significant innovation in data analytics, which, in turn, is accelerating business outcomes and mitigating risk in banking and financial services. It’s also changing how customers interact with and benefit from their banking relationships. This expert panel will delve into the evolving use cases of GenAI within banking and provide a roadmap for success.

The urgency of personalization and customer experience over the next five years is being driven by customers that are demanding products and services tailored—in real time—to their individual needs and smoother, frictionless experiences across platforms and channels. The ability of banks to deliver on both will drive customer acquisition and growth. Artificial intelligence is playing a central role in banks’ ability to use data-driven insights to capitalize on the hyper-personalization of financial services, including predictive engagement for real-time CX. Yet the vast opportunities must be balanced with operational commitment and execution on privacy, trust and compliance concerns.

Bank-fintech partnerships can enable community banks to leverage new technologies and compete with larger banks in offering innovative products and services. Learn about the different types of fintech partnerships–operational technology, customer oriented and front-end (BaaS)–and how to develop a playbook for community banks to gain a competitive edge over other banks and nonbanks.

A spike in account-to-account (A2A) instant payments—accelerated by the effects of an instant-everything culture—is challenging the banking industry. The rise of A2A instant payments is forcing banks to confront a vastly different model and fast-moving innovation that gives customers more control and strips out intermediaries. The panel examines the innovation and cultural forces driving this change, who’s leading the charge on A2A instant payments, what it means for consumers, potential fraud implications of exploding usage and what’s at stake for incumbents.

AI is transforming the future of lending. But without the right foundation, it risks becoming another checkbox rather than a competitive edge. Most banks remain stuck in pilot mode with AI, with limited use, minimal integration, and disconnected systems. This session dives into what it truly takes to move from test mode to full throttle, and steer beyond automation to achieve process autonomy. Explore the core digital capabilities, including integrated journeys, omnichannel experiences, unified workflows and real-time data access, that must be in place for AI to deliver maximum impact. Discover how an AI-first lending platform can enhance customer experience (CX), drive revenue growth, and increase operational efficiency. Backed by real-world examples, this session will show you how to shift gears and make AI a game-changer.

Introduction by Melinda Huspen, Technology Reporter, American Banker

How consumer expectations are evolving. Subscriptions are everywhere, and while we love them for their ease and convenience, they’re becoming more difficult to manage – in fact, 35% of consumers find managing their subscriptions difficult. For issuers, this presents a unique opportunity to reinvent how subscriptions are managed to not only improve the experience, but also inspire customers to return time and time again.

Introduction by Melinda Huspen, Technology Reporter, American Banker

The state of financial wellness in America is often a hotly debated issue and has been a catalyst for innovation. As consumers lean into social media influencers and fintech apps to improve their budgeting, saving, investing and other financial decision-making capabilities, banks have a new mandate and a unique opportunity to make a significant impact: Leverage the powerful combination of digital access, mobile tools and behavioral finance to meet consumers where they are, regardless of the platform or stage of their financial wellness journey. By developing mobile-enabled strategies, banks can create a new financial wellness path for consumers, helping them to enhance their functional skills while also understanding the psychology behind their decisions about money. Panelists discuss the need for banks to go beyond financial literacy offerings, why digital and mobile channels are key to reaching consumers more effectively, and how they can help consumers better understand the emotions, values and life experiences that shape their financial decisions—and how to adjust their behaviors to improve their financial well-being.

In today’s digital landscape, small businesses expect more than basic banking. They want tools that support their growth. Lili and Dun & Bradstreet have partnered to offer an embedded solution combining banking, accounting and tax prep. In this session, the focus is on how they are delivering a unified digital experience, why embedded finance is key to future fintech-bank collaborations and how financial institutions can expand their digital value.

Introduction by Mary Ellen Egan, Senior Director, Strategy and Content, American Banker Live Media

Indulge in a taste of tomorrow at the Bank of the Future Lunch, exclusively hosted on the Experience Hall floor during the Digital Banking Conference.

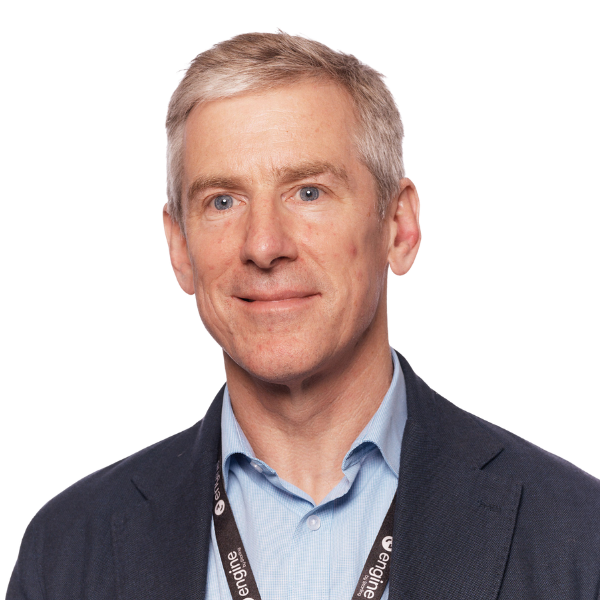

Join GFT and Engine by Starling, the technology arm of one of the world’s leading digital banks Starling Bank, for this engaging lunch session. We’ll explore how a digital mindset isn’t just about offering online and mobile channels; it’s about redefining how you deliver value. As well as discuss the difference between mobile only banking and digital banking, and how modern cloud native technology enables a fundamentally different way of running a bank that customers love and is efficient to run. The session will spotlight Salt Bank, Romania’s first digital bank, which was built and launched in just 12 months on Engine’s platform and masterfully integrated and implemented by GFT.

Discover how AI is reshaping digital banking with hyper-personalized experiences. Join Fiserv’s Digital Team to explore key technologies like machine learning and predictive analytics, showing how financial institutions can enhance customer engagement, security, and efficiency.

Amid wavering public trust in banks and accelerating interest in the digital asset ecosystem, it has become clear that fully reserved, blockchain-based stablecoins offer a safer, more transparent, and more equitable alternative to the current fractional reserve model that banks employ. As regulatory clarity improves and adoption accelerates, Mike Belshe will discuss why stablecoins are poised to become the foundational layer of a new financial system and redefine banking as we know it.

Introduction by: Bailey Reutzel, Senior Director, Strategy and Content, American Banker Live Media

A super-panel of experts and industry players explores the coming wave of opportunities for banks and other traditional financial institutions—and competitive challenges if they resist—to participate in on-chain finance, offering custody solutions, issuing and managing stablecoins for cross-border payments and remittances, tokenization of traditional financial assets, etc. What’s at stake? TradFi as we know it—finally.

Payroll and workforce management providers are embedding instant wage access and virtual wallets into their platforms to give employers the ability to provide employees with greater options as to when and how they get paid. Yet these embedded solutions suggest another emerging trend: That employees could soon also have access to more affordable consumer bank products and financial tax and health benefits through their employers’ payroll and workforce management platforms, particularly as younger workers look to “unbank” themselves.

Introduction: Holly Sraeel, SVP, Strategy and Content, American Banker Live Media

Wind down and network in style as the day’s excitement culminates in our exclusive conference Experience Hall cocktail reception. Join fellow attendees, speakers and innovators for an evening of mingling, note swapping and potential deal making. Savor delectable hors d’oeuvres and signature cocktails as you reflect on the day’s biggest insights and notable innovations.

The AI revolution continues. Already a new breed of artificial intelligence has transformed chat, search, image creation and much more. And now agentic AI — systems capable of independent adaptive problem-solving and decision-making — are coming to financial services. Banks, fintechs, crypto providers and more are experimenting with building digital workforces that can increase efficiency and productivity, and even add some creativity to financial services. The industry is placing strong bets on the technology. As of 2024, the market value of agentic AI was $5.1 billion, and Capgemini projects its market value will exceed $47 billion by 2030. Hear from leading experts on how to build, where to deploy and what challenges might arise from utilizing the bots.

In recent years, there has been a rapid acceleration in efforts to transform the customer experience in banking, making it easier for customers to open accounts, deposit money, make payments and verify information. At the same time, banks face increasing fraud risks, placing an emphasis to mitigate that risk at the center of any customer experience initiatives. In this session, American Banker research lead and industry panelists explore the best practices that banks and credit unions are adopting to manage and mitigate fraud risks, specifically looking at the tools and technologies used to verify and authenticate customer identity to ensure secure, low friction experiences across all channels.

As innovation accelerates, economic uncertainty grows and the regulatory environment seems fluid, this super-panel discussion with high-profile executives from across the digital finance landscape, including banks and financial institutions, fintechs, venture capitalists, and management consultants, takes the audience through five or so critical themes that will drive the future of digital finance over the next five years and the implications for players industry-wide. Themes to be explored include the dramatic rise of account-to-account (A2A) payments, social commerce and payments, the institutionalization of generative and agentic artificial intelligence, the mainstreaming of stablecoin payments and on-chain finance, the emergence of new models for Banking-as-a-Service and Payments-as-Service, and the impact of cyber risks on identity verification, privacy and compliance are among the top-of-mind trends.

For decades, payroll and banking have operated in parallel—one managed by employers, the other by financial institutions. But for workers, these systems are inseparable. People don’t think about their money in silos; they think in dollars and cents: work, earn, spend, borrow, save, repeat.

Technology is finally catching up to that expectation. By dissolving the legacy boundaries between payroll and banking, we can create a continuous financial experience that starts with earning and seamlessly powers every aspect of a person’s financial life.

This isn’t just an operational shift. It’s a new paradigm, where financial services start at the paycheck. By reimagining how banking can integrate with payroll we can unlock a new era of financial wellness and inclusion for millions of everyday Americans.

Introduction by: Bailey Reutzel, Senior Director, Strategy and Content, American Banker Live Media